Zero Coupon Bond Arbitrage Example . Let's assume that we have annual coupon credit risk free bonds that trade along side. • we can observe the prices of zeroes in the form of. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? The portfolio is constructed so that the cash. — simple example of arbitrage.

from www.chegg.com

• we can observe the prices of zeroes in the form of. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? — simple example of arbitrage. Let's assume that we have annual coupon credit risk free bonds that trade along side. The portfolio is constructed so that the cash.

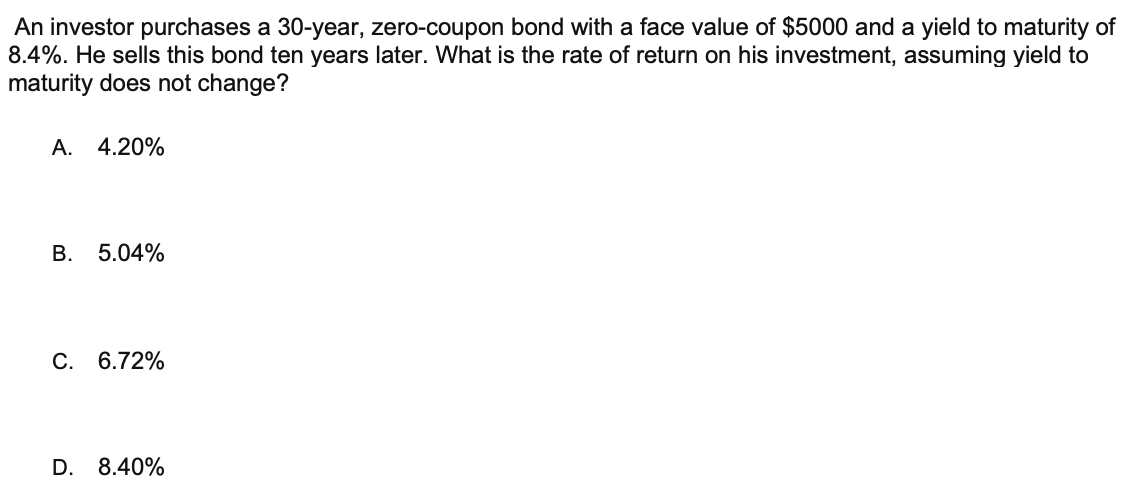

Solved An investor purchases a 30year, zerocoupon bond

Zero Coupon Bond Arbitrage Example Let's assume that we have annual coupon credit risk free bonds that trade along side. The portfolio is constructed so that the cash. Let's assume that we have annual coupon credit risk free bonds that trade along side. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? • we can observe the prices of zeroes in the form of. — simple example of arbitrage.

From www.slideserve.com

PPT Chapter 12 Bond Prices and the Importance of Duration PowerPoint Zero Coupon Bond Arbitrage Example The portfolio is constructed so that the cash. — simple example of arbitrage. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? Let's assume that we have annual coupon credit risk free bonds that trade along side. • we can observe the prices of zeroes in the form. Zero Coupon Bond Arbitrage Example.

From www.youtube.com

2 NZCBV NonZero Coupon Bond Long Term Security Financial Zero Coupon Bond Arbitrage Example — simple example of arbitrage. • we can observe the prices of zeroes in the form of. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? Let's assume that we have annual coupon credit risk free bonds that trade along side. The portfolio is constructed so that the. Zero Coupon Bond Arbitrage Example.

From www.youtube.com

Zero coupon bond. Features of zero coupon bond YouTube Zero Coupon Bond Arbitrage Example — simple example of arbitrage. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? • we can observe the prices of zeroes in the form of. The portfolio is constructed so that the cash. Let's assume that we have annual coupon credit risk free bonds that trade along. Zero Coupon Bond Arbitrage Example.

From www.dreamstime.com

ZeroCoupon Bond Text Concept Closeup. American Dollars Cash Money,3D Zero Coupon Bond Arbitrage Example — simple example of arbitrage. • we can observe the prices of zeroes in the form of. Let's assume that we have annual coupon credit risk free bonds that trade along side. The portfolio is constructed so that the cash. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every. Zero Coupon Bond Arbitrage Example.

From www.indiabonds.com

ZeroCoupon Bonds Definition, Pricing, and Benefits IndiaBonds Zero Coupon Bond Arbitrage Example where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? • we can observe the prices of zeroes in the form of. Let's assume that we have annual coupon credit risk free bonds that trade along side. — simple example of arbitrage. The portfolio is constructed so that the. Zero Coupon Bond Arbitrage Example.

From study.com

Quiz & Worksheet What is a Zero Coupon Bond? Zero Coupon Bond Arbitrage Example — simple example of arbitrage. Let's assume that we have annual coupon credit risk free bonds that trade along side. • we can observe the prices of zeroes in the form of. The portfolio is constructed so that the cash. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every. Zero Coupon Bond Arbitrage Example.

From www.dreamstime.com

Zero Coupon Bond is a Bond in Which the Face Value is Repaid at the Zero Coupon Bond Arbitrage Example — simple example of arbitrage. The portfolio is constructed so that the cash. • we can observe the prices of zeroes in the form of. Let's assume that we have annual coupon credit risk free bonds that trade along side. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every. Zero Coupon Bond Arbitrage Example.

From www.chegg.com

Problem 6. No arbitrage price of coupon bond. We Zero Coupon Bond Arbitrage Example — simple example of arbitrage. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? • we can observe the prices of zeroes in the form of. Let's assume that we have annual coupon credit risk free bonds that trade along side. The portfolio is constructed so that the. Zero Coupon Bond Arbitrage Example.

From www.chegg.com

Solved The yield to maturity (YTM) on 1year zerocoupon Zero Coupon Bond Arbitrage Example where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? • we can observe the prices of zeroes in the form of. Let's assume that we have annual coupon credit risk free bonds that trade along side. — simple example of arbitrage. The portfolio is constructed so that the. Zero Coupon Bond Arbitrage Example.

From tradesmartonline.in

What Are Zero Coupon Bonds? Valuable Insights TradeSmart Zero Coupon Bond Arbitrage Example • we can observe the prices of zeroes in the form of. Let's assume that we have annual coupon credit risk free bonds that trade along side. — simple example of arbitrage. The portfolio is constructed so that the cash. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every. Zero Coupon Bond Arbitrage Example.

From www.chegg.com

Solved An investor purchases a 30year, zerocoupon bond Zero Coupon Bond Arbitrage Example — simple example of arbitrage. • we can observe the prices of zeroes in the form of. Let's assume that we have annual coupon credit risk free bonds that trade along side. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? The portfolio is constructed so that the. Zero Coupon Bond Arbitrage Example.

From www.scribd.com

Zero Coupon Bond Forward PDF Arbitrage Bonds (Finance) Zero Coupon Bond Arbitrage Example • we can observe the prices of zeroes in the form of. The portfolio is constructed so that the cash. — simple example of arbitrage. Let's assume that we have annual coupon credit risk free bonds that trade along side. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every. Zero Coupon Bond Arbitrage Example.

From www.ferventlearning.com

Zero Coupon Bonds Explained (With Examples) Fervent Finance Courses Zero Coupon Bond Arbitrage Example — simple example of arbitrage. The portfolio is constructed so that the cash. • we can observe the prices of zeroes in the form of. Let's assume that we have annual coupon credit risk free bonds that trade along side. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every. Zero Coupon Bond Arbitrage Example.

From www.indiabonds.com

Difference between Zero Coupon Bonds and Deep Discount Bonds IndiaBonds Zero Coupon Bond Arbitrage Example Let's assume that we have annual coupon credit risk free bonds that trade along side. • we can observe the prices of zeroes in the form of. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? — simple example of arbitrage. The portfolio is constructed so that the. Zero Coupon Bond Arbitrage Example.

From accountantskills.com

ZeroCoupon Bond Definition, Formula, Example etc. Accountant Skills Zero Coupon Bond Arbitrage Example The portfolio is constructed so that the cash. Let's assume that we have annual coupon credit risk free bonds that trade along side. — simple example of arbitrage. • we can observe the prices of zeroes in the form of. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every. Zero Coupon Bond Arbitrage Example.

From ppt-online.org

Valuing bonds. (Lecture 6) презентация онлайн Zero Coupon Bond Arbitrage Example Let's assume that we have annual coupon credit risk free bonds that trade along side. — simple example of arbitrage. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? • we can observe the prices of zeroes in the form of. The portfolio is constructed so that the. Zero Coupon Bond Arbitrage Example.

From www.chegg.com

Solved Question 2 (40 marks) A 4year zero coupon bond has a Zero Coupon Bond Arbitrage Example The portfolio is constructed so that the cash. Let's assume that we have annual coupon credit risk free bonds that trade along side. • we can observe the prices of zeroes in the form of. — simple example of arbitrage. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every. Zero Coupon Bond Arbitrage Example.

From walletinvestor.com

What is the difference between a zerocoupon bond and a convertible Zero Coupon Bond Arbitrage Example Let's assume that we have annual coupon credit risk free bonds that trade along side. where can you find the market rates of interest (or equivalently the zero coupon bond prices) for every maturity? The portfolio is constructed so that the cash. • we can observe the prices of zeroes in the form of. — simple example of. Zero Coupon Bond Arbitrage Example.